RENIXX Halts Downtrend, Hits Yearly High – Bloom Energy, Solaredge, and Nordex Shine in Year-to-Date Performance

Muenster – The global stock index RENIXX (Renewable Energy Industrial Index) reached a new yearly high of 1,056.13 points on September 22, 2025. This puts the index 7.5% above its level at the beginning of the year, signaling a recovery after several years of declines. The RENIXX includes the 30 largest companies in the sector worldwide by market capitalization and has tracked the global development of renewable energy since 2002.

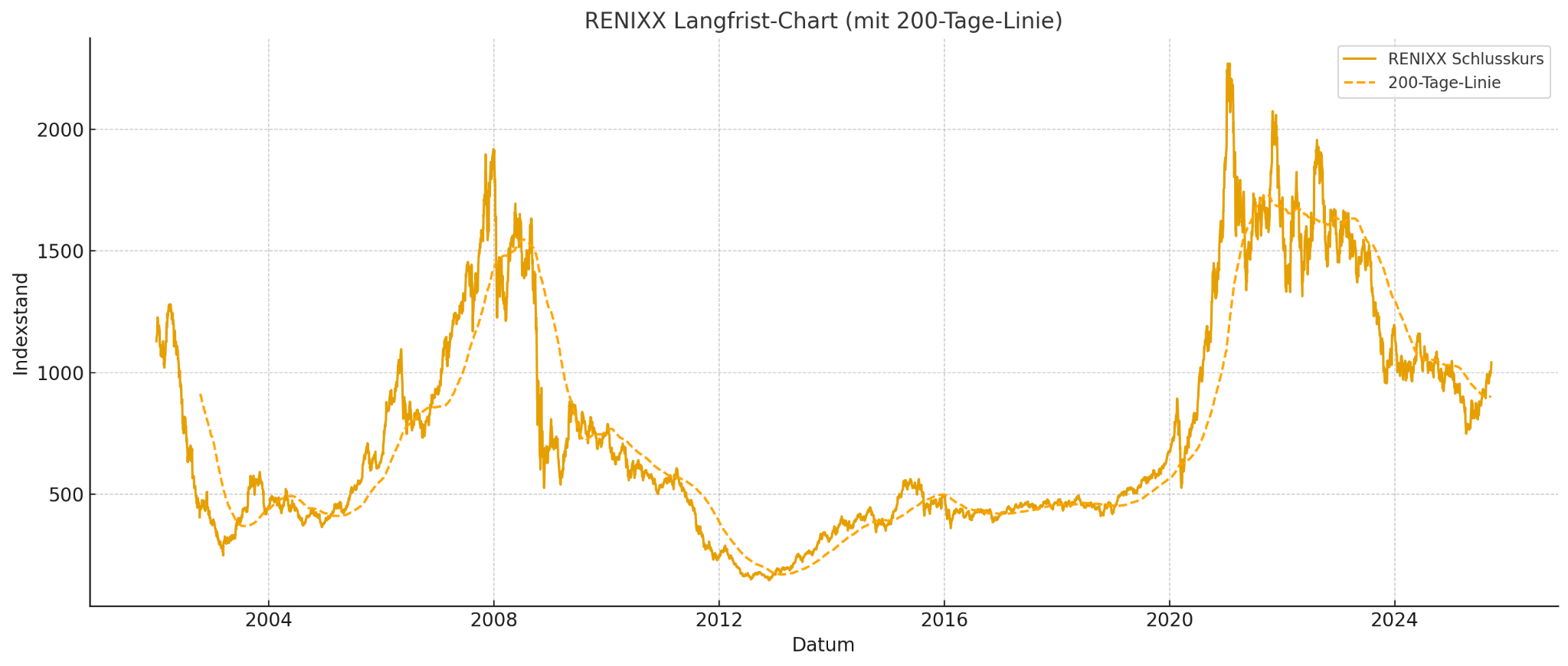

Historically, RENIXX has experienced two pronounced boom-bust cycles, the latest beginning in 2020. After an unprecedented rise from just under 530 points (2020) to an all-time high of 2,271 points on January 26, 2021, the index gradually fell in several stages to 749 points by April 9, 2025. At this level, RENIXX appears to have found a temporary bottom and has been trending upward since.

RENIXX Price Development and Boom-Bust Cycle 2020–2025

Looking at the years from 2020 onward, a nearly complete boom-bust cycle appears likely. The RENIXX surge was fueled by ultra-low interest rates and the announcement of U.S. President Joe Biden’s Inflation Reduction Act (IRA), which pushed green U.S. stocks sharply higher. Subsequent external shocks, including the COVID-19 pandemic and Russia’s invasion of Ukraine, led to energy-driven inflation, rising interest rates, and significant supply chain disruptions.

These factors contributed to continued sharp price declines in the U.S., further reinforced by the political shift under Donald Trump, who favors fossil fuels and slows the adoption of green technologies.

Despite this headwind from the U.S., RENIXX seems to have found a bottom in May 2025. Since then, the index has shown a clear upward trend. Its current level marks a potential trend reversal after years of consolidation, as also indicated by the 200-day moving average on the chart.

Top Performers of 2025: Bloom Energy, Solaredge, and Nordex

The strongest gainers year-to-date are mainly in the hydrogen/fuel cell, solar, and wind energy sectors. Leading the pack is Bloom Energy, up 233%, driven largely by an Oracle deal supplying fuel cells for AI data centers that can provide electricity within months—a clear advantage over mini nuclear plants, which are not expected to be operational before 2030.

Solaredge Technologies rose 147.3%, and Nordex recorded a robust gain of 85%. Other notable performers include Goldwind Science & Technology (+62.5%), Ballard Power Systems (+55.8%), and Sunrun (+55.7%). European companies such as SMA Solar Technology (+52.4%) and the U.S. geothermal and storage specialist Ormat Technologies (+21.1%) also contributed to the positive trend with significant double-digit gains.

In contrast, some companies remained under pressure: Ørsted lost 63.6% since the start of the year, partly due to a recent capital increase and the Trump-ordered halt of the Revolution Wind offshore project. Enphase Energy fell 50.1%, and JinkoSolar dropped 14%. Austrian energy provider Verbund (-13.4%) suffered from falling electricity prices and lower margins, while Canadian developer and operator Boralex (-13.9%) also remained well below its year-start level.

Overall, RENIXX continues to reflect the volatility of the global renewable energy market. The slowdown of green energy technologies in the U.S. has now been priced in, and the weighting of U.S. stocks in the index has noticeably declined. After several years of consolidation, potential for an upward trend is emerging once again.

Source: IWR Online, Sep 09 2025