Annual Review 2025: RENIXX up 15 Percent - Shares of Bloom Energy, Grenergy and Nordex Post Triple-Digit Gains - BYD and Ørsted Under Pressure

Münster (Germany) - After two weak previous years, the RENIXX World rebounded strongly in 2025. While some stocks in the solar, wind, and hydrogen sectors achieved triple-digit price gains, other companies recorded significant losses. Price performance reflects both macroeconomic and company-specific factors.

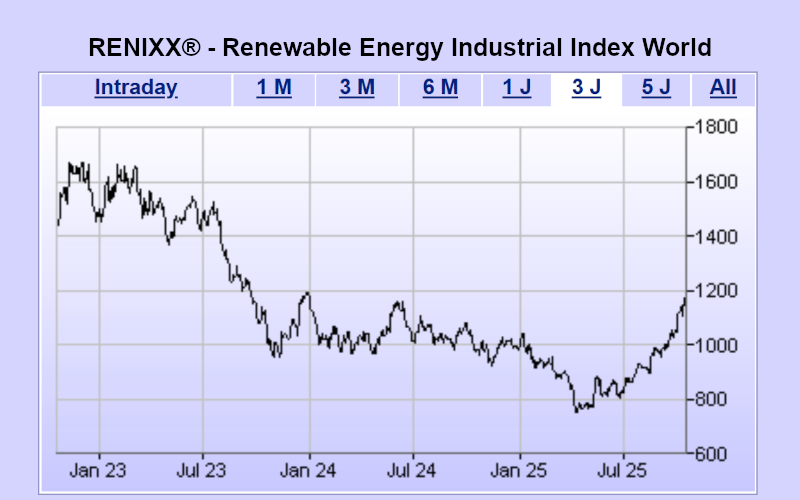

Technical Situation: RENIXX Stable Between 1,000 and 1,200 Points

From the end of 2023 until January 2025, the RENIXX moved sideways within a range between 1,000 and 1,200 points. The subsequent decline to 748 points marked a significant intermediate low and continues to represent the key support zone in the longer-term chart.

With increasing volatility, the index rose to just under 1,300 points, reaching the upper boundary of the former trading range. Profit-taking then pushed the index back down significantly, at times close to the 1,000-point level. Following a rebound and a neutral sideways phase, the RENIXX ended the final trading week of 2025 with a slight gain. Only a breakout above 1,200 points or another drop below 1,000 points would redefine the overall technical outlook.

RENIXX World 2025: Top Gainers and Strong Price Developments

Bloom Energy shares rose 241 percent in 2025, climbing from €22 to €75.01. The U.S. hydrogen and fuel-cell specialist significantly increased revenue and margins during the first three quarters of 2025. In addition, the company benefited from growing demand for hydrogen and energy storage solutions, strengthening investor confidence. Commercial progress was further underscored by a partnership with Brookfield Asset Management worth USD 5 billion and collaborations with Oracle in the field of AI data centers.

Grenergy Renovables benefited from the expansion of its solar and storage projects in Europe and Latin America. The company increased revenue in the first half of 2025 by more than 100 percent to €438 million, while EBITDA rose by around 180 percent, highlighting operational strength and growth prospects. By the end of 2025, Grenergy shares ranked second in the RENIXX, up 164 percent to €84.60.

Also among the top three RENIXX companies was German wind turbine manufacturer Nordex, whose share price climbed 157.5 percent to €29.18 in 2025. The performance was supported by strong order intake in Europe and North America. For the first nine months of 2025, the company reported cumulative orders of more than 6.7 GW (9M/2024: 5.08 GW), while improvements in production and cost efficiency boosted margins and positively influenced investor sentiment.

RENIXX Losers 2025: BYD and Ørsted Under Pressure

At the bottom of the RENIXX ranking, Chinese e-mobility group BYD brought up the rear. Over the year, the share price fell 67.5 percent to €10.73. BYD’s profit and revenue declined in several quarters, and its market share in China decreased. In addition, the Chinese EV market has been burdened by intense price competition, squeezing margins and disappointing investors.

Ørsted shares also came under heavy pressure, falling 63.3 percent to €16.14. The sharp decline was driven in part by political intervention by the U.S. government under President Trump, which led to the suspension of key offshore wind projects and increased economic risks for the company. For example, the government ordered a construction halt on the nearly completed Revolution Wind project, resulting in uncertainty, a capital increase, and significant share price losses.

RENIXX with a New Composition: Additions and Removals in 2025

A total of six companies entered or exited the RENIXX during 2025. As part of the regular minor weighting adjustment on April 1, 2025, Chinese e-mobility company Xpeng and Norwegian renewable operator and utility Meridian Energy were added. In return, French renewable operator Neoen, which was acquired by Brookfield, and U.S. electric vehicle manufacturer Tesla were removed.

As part of the adjustment on October 1, 2025, Chinese e-mobility group BYD, offshore service provider Cadeler, biofuel producer Green Plains, and Spanish operator Grenergy Renovables were added to the RENIXX. Removed from the index were ReNew Energy Global, SMA Solar, SFC Energy, and Verbio.

RENIXX World 2026: Positive Start to the Year

In the first two trading days of the new year, the RENIXX showed a friendly trend. After gaining 2.5 percent on the first trading day, the index is currently up 1.2 percent at 1,172.5 points.

About the Global Stock Index RENIXX World

The RENIXX® World (Renewable Energy Industrial Index, ISIN: DE000RENX014) is the world’s first stock index for renewable energies and the oldest global stock market benchmark for this industrial future sector. It covers wind energy, solar energy, bioenergy, geothermal energy, hydropower, e-mobility, hydrogen, and fuel cells.

The index includes 30 international companies with the highest free-float market capitalization and reflects both the performance and the global market development of the renewable energy industry.

The RENIXX was launched on May 1, 2006, with a base value of 1,000 points; a historical back-calculation to 2002 was conducted. The index is available via leading financial media and data providers such as Bloomberg, Reuters, Financial Times, BlackRock (Aladdin), and Wallstreet Online.

Source: IWR Online, Jan 01 2026